Highlights

• Airtel Launches Fraud Alarm and Transparent Banking section for its users under the banking section of the Airtel Thanks app.

• The Bank showcased these solutions at the Global Fintech Fest 2024.

Airtel Payments Bank is setting a new benchmark in digital banking by introducing two ground-breaking features in the banking section under the Airtel Thanks app: the Fraud Alarm and Transparent Banking.

The two features are designed to elevate user experience by offering enhanced security and greater transparency in banking operations.

The Bank showcased these solutions at the Global Fintech Fest 2024.

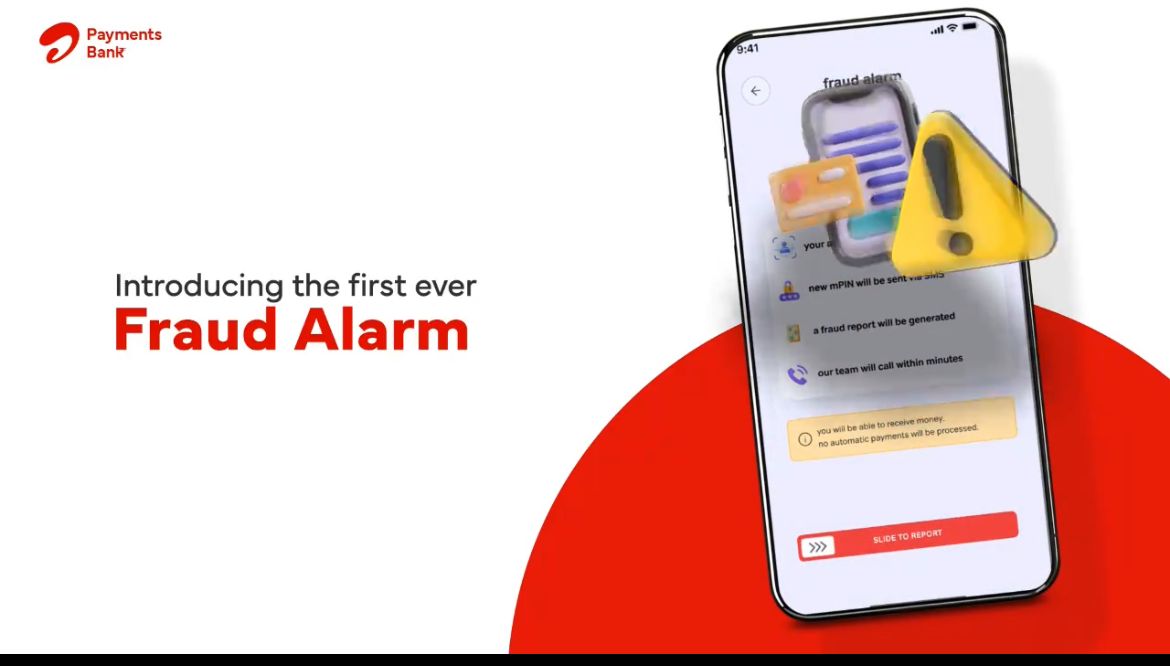

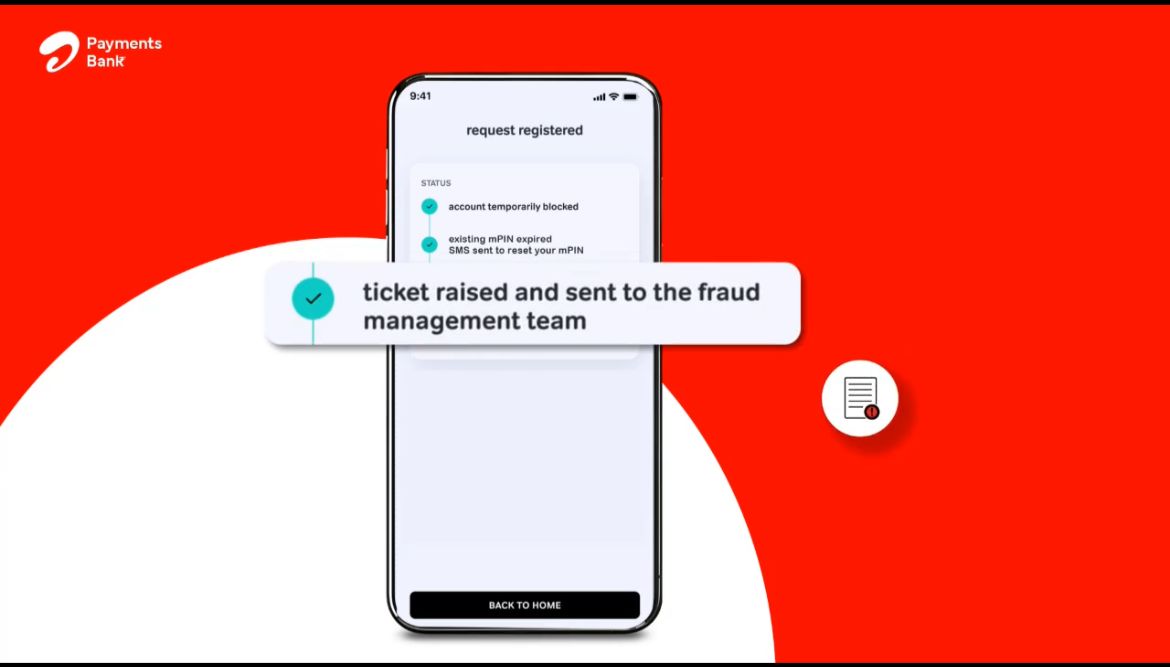

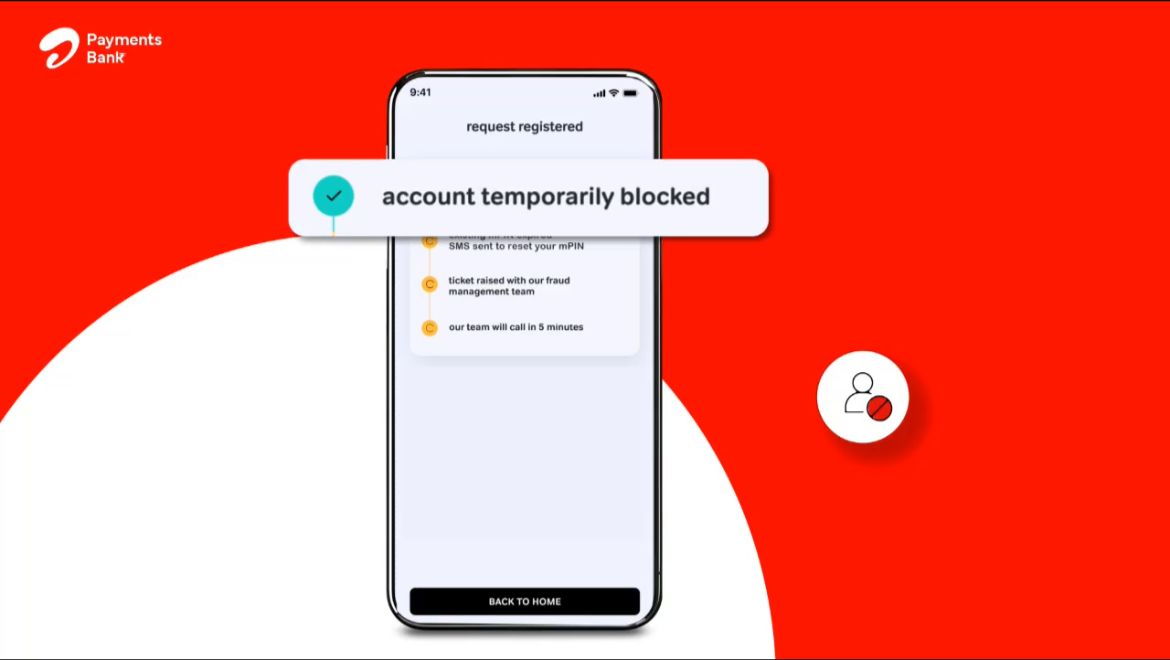

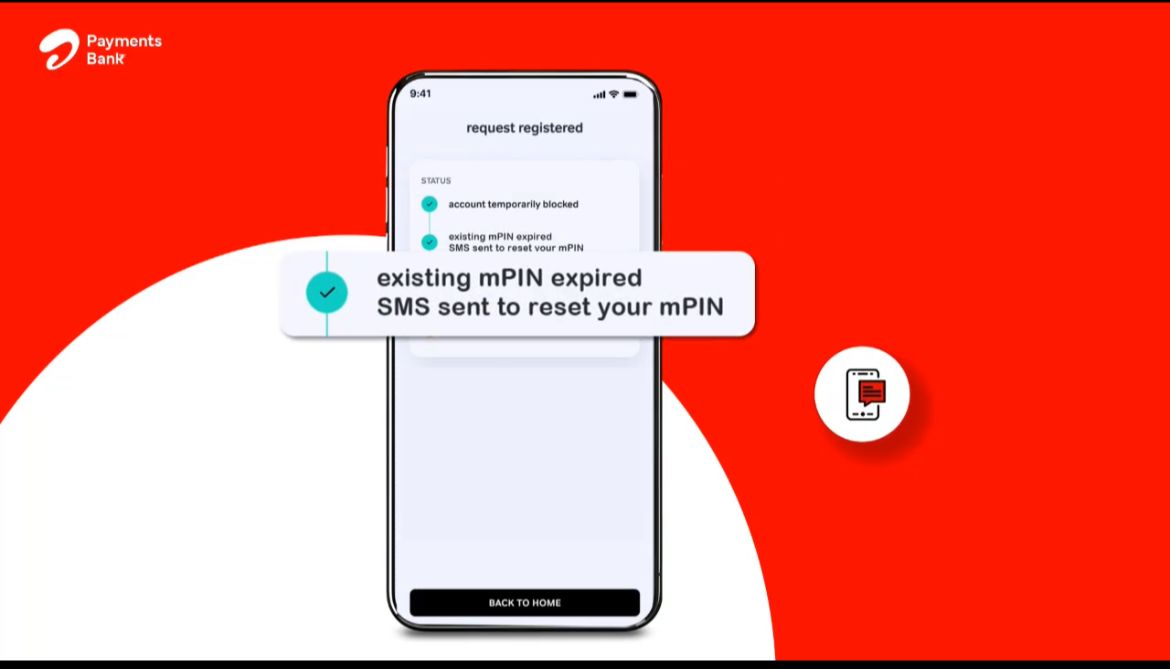

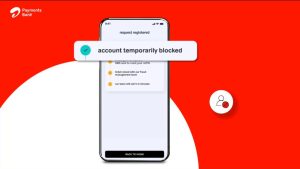

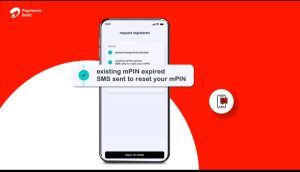

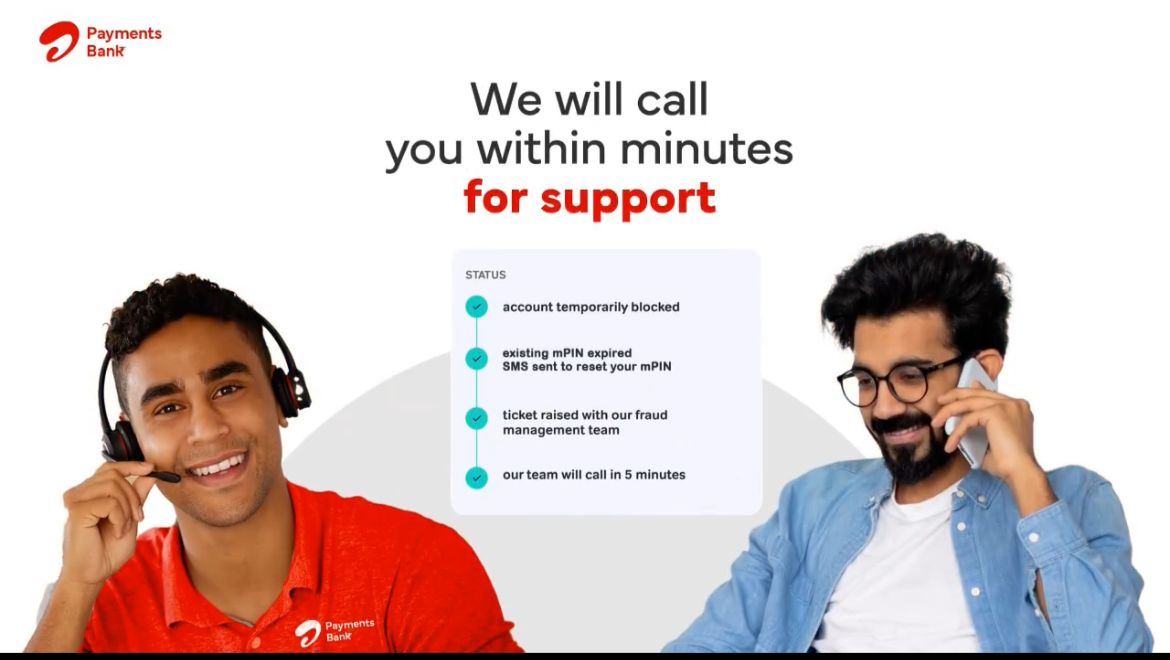

The Fraud Alarm, prominently positioned in the Safe Bank Section on the app, provides users with immediate assistance if they suspect fraudulent activity.

With a single swipe, users can quickly report suspicious transactions, initiate service requests for them, and secure their accounts to prevent further transactions.

This streamlined approach ensures rapid response and effective resolution, empowering users and the Bank to take swift action against potential fraud.

#InnovationAlert

We are elated to unveil our Transparent Banking section, designed to offer simple, easy and honest banking with clarity in every transaction, at @GffFintechfest#AirtelPaymentsBank #Fintech #SafeBanking #DigitalBanking #TransparentBanking #GFF2024 pic.twitter.com/9m5xN7qq30— Airtel Payments Bank (@airtelbank) August 29, 2024

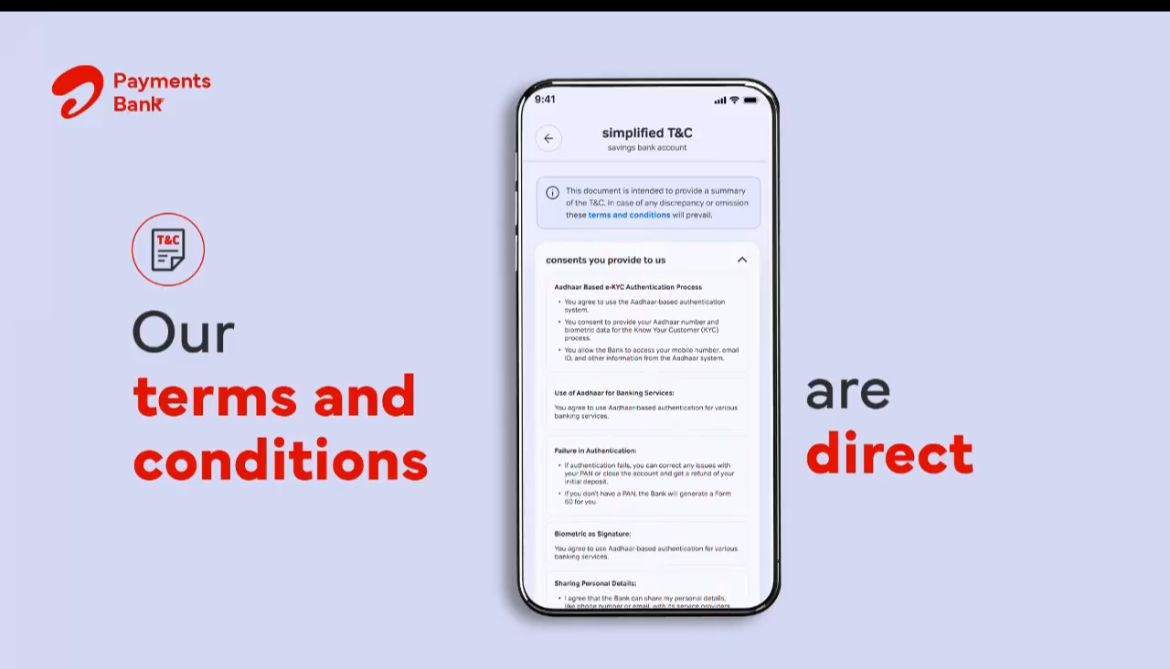

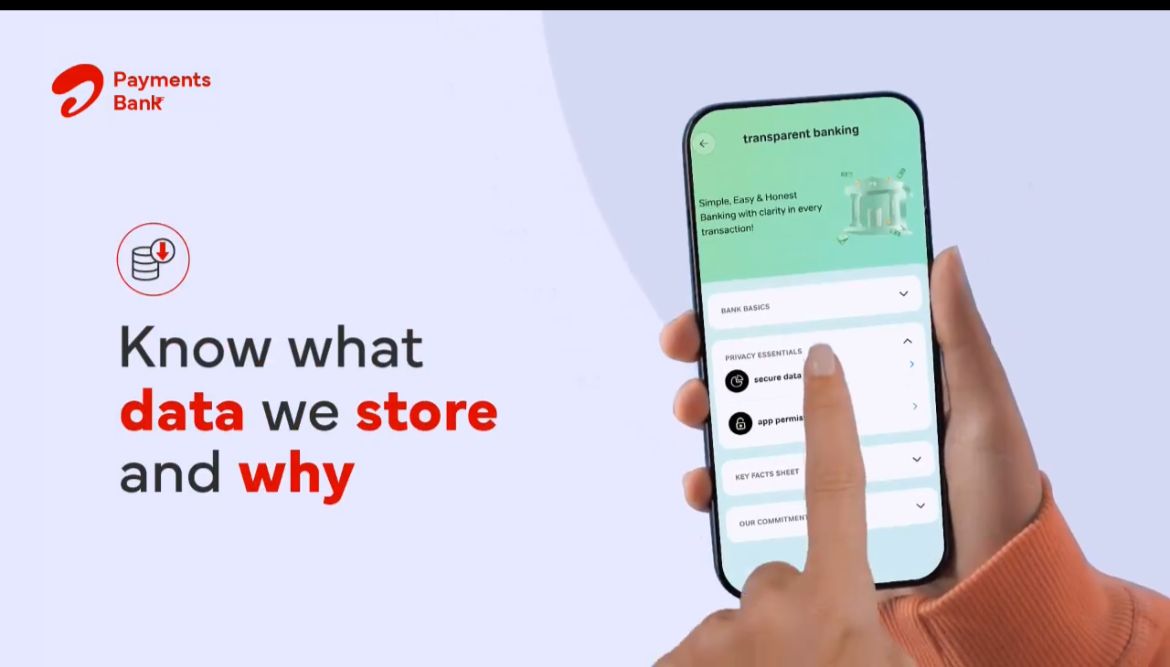

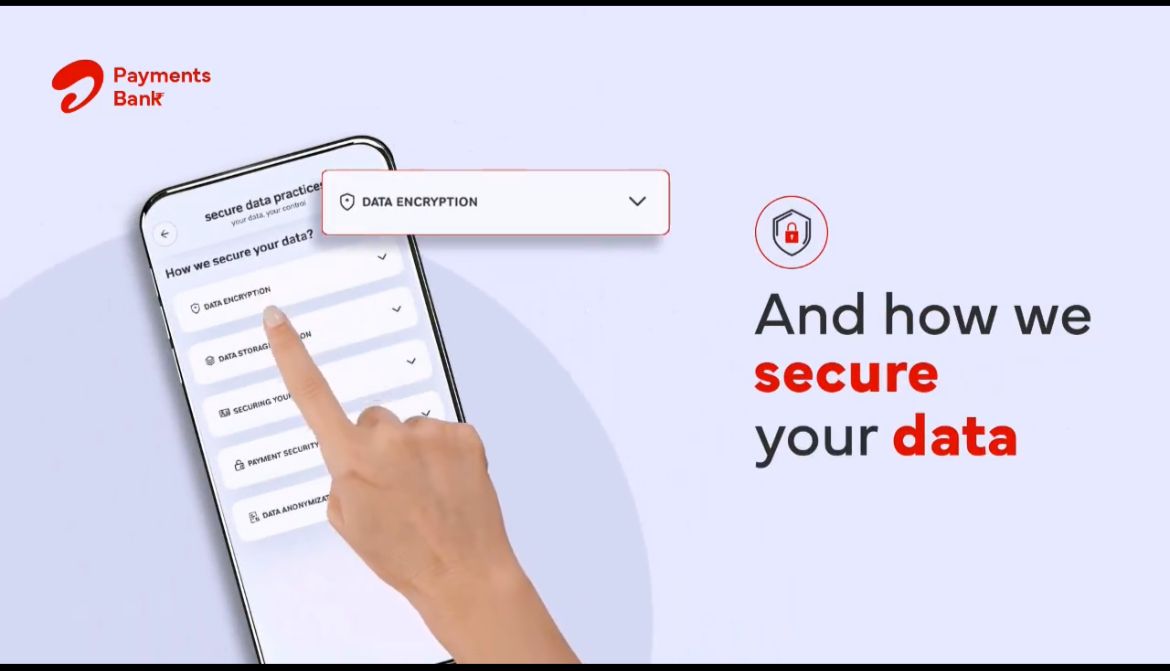

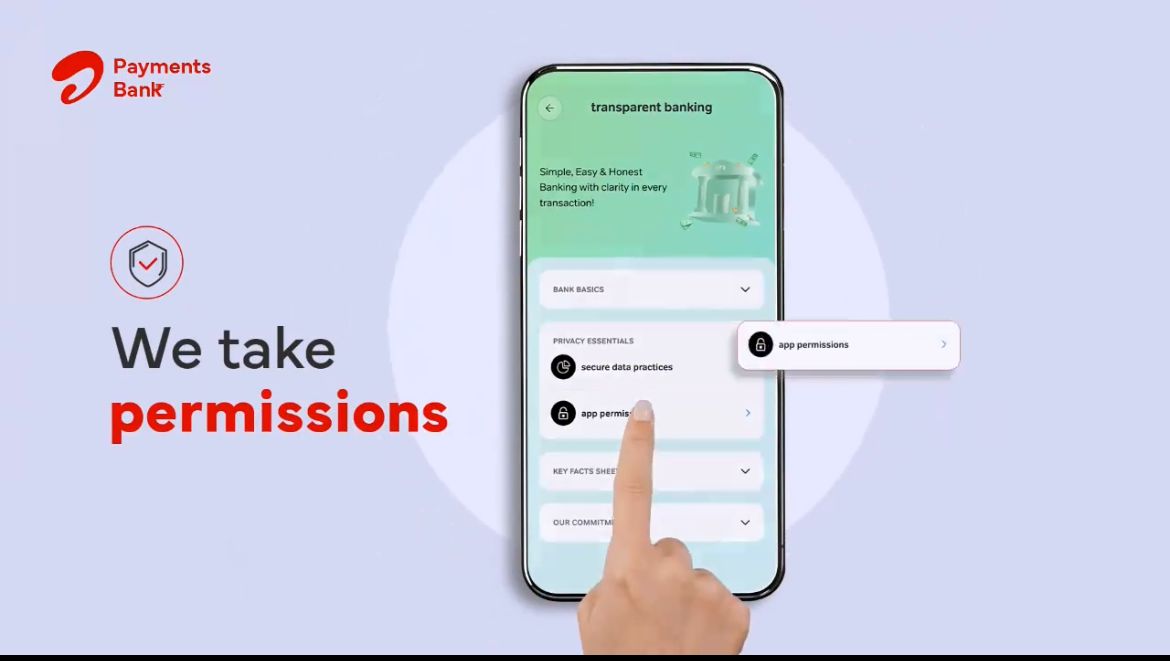

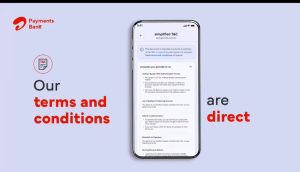

Complementing the security feature, the Transparent Banking section on the app is designed to redefine the banking experience by centralizing all essential information – including charges, terms & conditions, and customer data storage guidelines – in simplified language in one easily accessible and user-friendly section.

It also details why various device permissions are necessary for the app, providing transparency regarding user privacy protection and ensuring that customers are informed about the data the app accesses.

#InnovationAlert

We’re thrilled to announce the launch of our latest innovation – The Fraud Alarm, a feature designed for immediate assistance in case of a fraudulent transaction with a single swipe. #AirtelPaymentsBank #Fintech #GFF2024 #SafeBanking #DigitalBanking pic.twitter.com/sxEL3Z9jrd— Airtel Payments Bank (@airtelbank) August 29, 2024

The Transparent Banking feature underscores the Bank’s commitment to offering simple, easy and honest banking with clarity in every transaction.

With this clarity, users can manage their finances with greater confidence and control.

Anubrata Biswas, MD and CEO of Airtel Payments Bank said at the Global Fintech Fest 2024, “At Airtel Payments Bank, we are dedicated to delivering solutions that blend security, transparency, and user-focused innovation, empowering our customers to manage their finances with greater confidence. The launch of the Fraud Alarm and Transparent Banking on the banking section in the Airtel Thanks app highlights our commitment to making banking simpler, safer, and more rewarding.”

Airtel Payments Bank is the sixth largest player amongst mobile banking users, and it processes over 8 billion transactions annually across its platforms.

FAQs

How do fraudsters operate Forged Phone Calls ?

Forged phone call is one such attempt where fraudsters possess as your relative / friend and ask you transfer the funds on immediate basis in their bank account/wallet.

1. Fraudster collects information about you from social networking sites like Facebook, Linkedin, twitter etc.

2. Fraudster calls customer and poses as a relative or friend or bank representative and talk to you about few scenarios which recently happened with you so that they can trick you in thinking that you actually know them.

3. Once they get confidence that you are in trap, they ask you to transfer some money (usually small amount ranging between INR 500 to 5000) in their bank account or wallet account citing medical reasons.

4. Once customer transfer the amount fraudster further transfer that money to their some other account so that transaction cannot be reversed.

— How to protect yourself from fraud:

1. Never share personal details on social networking sites.

2. Never transfer the funds without confirming the identity of the recipient as the money once transferred cannot be reversed.

3. Report all such incidents immediately on the Phone Banking number 400 or report it on https://airtel.in/netbanking wecare@airtelbank.com

How do fraudsters operate Phishing ?

Phishing is a type of fraud that involves stealing personal information such as Customer ID, mPIN, Credit/Debit Card number, Card expiry date, CVV number, etc. through emails that appear to be from a legitimate source, like Airtel Payments Bank.

1. Fraudsters send fake emails to customers which appears legitimate, asking them to urgently verify or update their account information by clicking on a link in the email.

2. Clicking on the link directs the customer to a fake website that looks like the official Bank website – with a web form to fill in his/her personal information.

3. Information so acquired is then used to conduct fraudulent transactions on the customer’s account.

— How to protect yourself from fraud:

1. Always check the web address carefully. Our Netbanking address is https://airtel.in/netbanking

2. For logging in, always type the website address in your web browser address bar.

3. Install the anti-virus, antispyware, firewall and security patches on your computer and mobile phones and keep updating them regularly.

4. DO NOT click on any suspicious link in your email.

5. DO NOT provide any confidential information via email, even if the request seems to be from authorities like Income Tax Department, Visa or MasterCard etc.

6. DO NOT open unexpected email attachments or instant message download links

7. DO NOT access NetBanking or make payments using your Credit/Debit Card from computers in public places like cyber cafes or even from unprotected mobile phones.

How to identify fake Phishing website / Mails?

1. Always check for the salutations in the mail, phishing mails are normally targeted to large audience so they put generic salutation like below, genuine mail always comes with your name.

2. Check the domain or email ID from where mail has come, generally fraudster try to build look alike email ID with some spelling changes like below:

3. Such mails comes with some kind of urgency and they threat you for some consequence if you ignore the mail.

4. When you click on URL it will redirect you to some website which will look alike the bank site but if you check the URL address then it would be different from bank site address.

5. Most fake web addresses start with ‘http://’. Legitimate site will always start with HTTPS, the ‘s’ at the end of ‘https://’ stands for ‘secure’ – meaning the page is secured with an encryption.

6. Check the Padlock symbol. This depicts the existence of a security certificate, also called the digital certificate for that website.

7. Establish the authenticity of the website by verifying its digital certificate. To do so, go to File > Properties > Certificates or double click on the Padlock symbol at the upper right or bottom corner of your browser window.

How do fraudsters operate sim swap ?

1. Fraudsters gather customer’s personal information through Phishing, Vishing, Smishing or any other means.

2. They then approach the mobile operator and get the SIM blocked. After this, they visit the mobile operator’s retail outlet with the fake ID proof posing as the customer.

3. The mobile operator deactivates the genuine SIM card and issues a new one to the fraudster.

4. Fraudsters then generates One Time Password (OTP) required to facilitate transactions using the stolen banking information. This OTP is received on the new SIM held by the fraudster.

— How to protect yourself from fraud:

1. If your mobile no. has stopped working for a longer than usual period, enquire with your mobile operator to make sure you haven’t fallen victim to the Scam.

2. Register for SMS and Email Alerts to stay informed about the activities in your bank account.

3. Regularly check your bank statements and transaction history for any irregularities.

How is the fraud alarm feature of the Airtel Payments Bank ?

The Fraud Alarm, prominently positioned in the Safe Bank Section on the app, provides users with immediate assistance if they suspect fraudulent activity.

With a single swipe, users can quickly report suspicious transactions, initiate service requests for them, and secure their accounts to prevent further transactions.

This streamlined approach ensures rapid response and effective resolution, empowering users and the Bank to take swift action against potential fraud.

How is the transparency banking section of the Airtel Payment Bank ?

Transparent Banking section on the app is designed to redefine the banking experience by centralizing all essential information – including charges, terms & conditions, and customer data storage guidelines – in simplified language in one easily accessible and user-friendly section.

What do we understand about Airtel Payments Bank through Transparent Banking Features?

The Transparent Banking feature underscores the Bank’s commitment to offering simple, easy and honest banking with clarity in every transaction.

With this clarity, users can manage their finances with greater confidence and control.

Also Read: Bharti Airtel 5G Service Goes Live; 4G Plan Payment for Consumers

Also Read: Airtel Payments Bank Collaborates with Noise and NPCI to unveil its Upcoming NCMC-Enabled Smartwatch