Highlights:

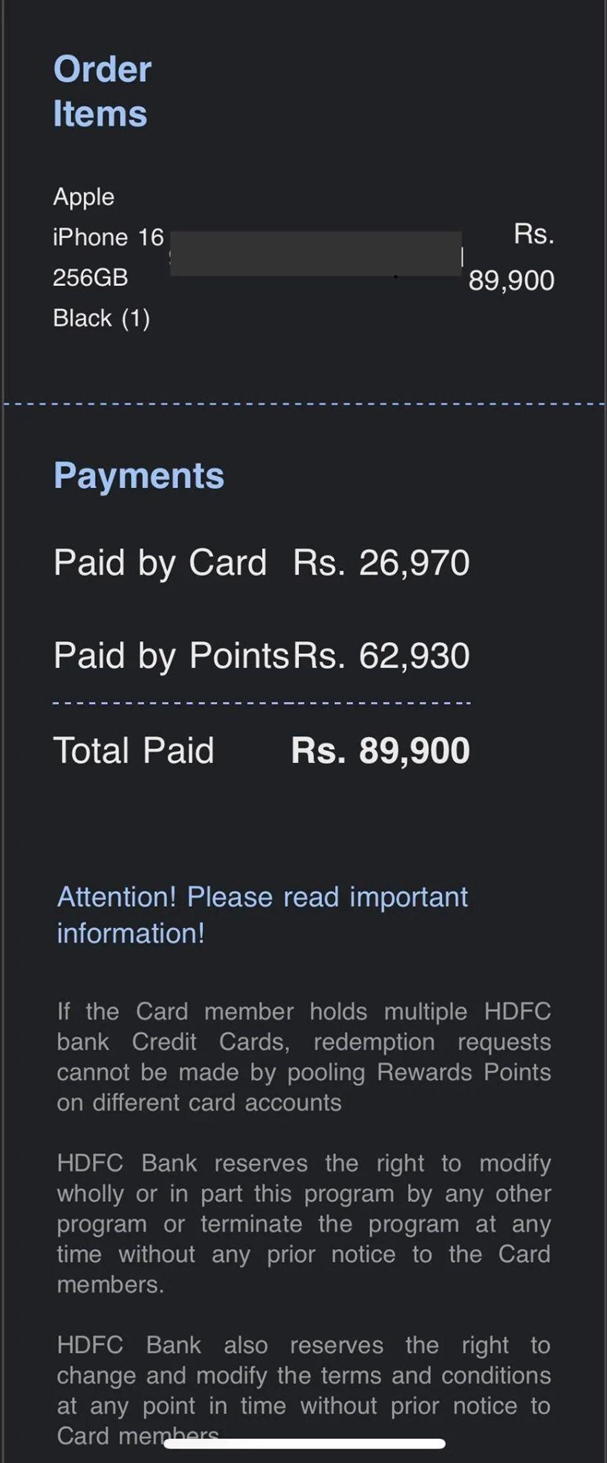

- A Reddit user scored an iPhone 16 (256GB) for just ₹27,000.

- The original price of the iPhone 16 is ₹89,900.

- The deal was made possible using HDFC Infinia credit card reward points.

Recently, a Reddit user made headlines as he bought the newly launched Apple iPhone 16 using credit card points at an astonishing rate of just ₹27,000.

Instead of claiming it as part of a sale or hidden promotion, he availed credit card reward points.

Here’s his full account of how he transformed his credit card into a powerful tool and was able to save over ₹60,000 on one of the most coveted gadgets of the year.

Reddit User Scores Apple iPhone 16 for ₹27,000 Using HDFC Credit Card Rewards

Recently, one Wild_Muscle3506 Redditor managed to blow up everybody’s feed after narrating his sizzle of getting an Apple iPhone 16 for as little as ₹27,000. The cost of this phone in the shop is ₹89,900. Hence, he saves more than ₹62,000 from his purchase. But at this point, everybody had one question- how did he pull it off?

However, the great deal comes with a flip side. The secret to this deal was credit card reward points. Wild_Muscle3506 used the HDFC Infinia Credit Card, a high-end card that reeks of luxury along with exclusive offers, benefits, and reward programs.

He pays an advance of ₹26,970 and then applies the reward points that he had saved through previous transactions for the remaining amount of ₹62,930, getting him the iPhone for just ₹27,000 out-of-pocket. Infinia cards are quite different from other credit cards.

It charges a yearly fee of ₹10,000, and because of that feature alone, it offers a higher rate of earning points, travel features, and more premium benefits that appeal to big spenders. The best part for anyone trying to save on a gadget is that this could be the ultimate dream.

But there’s also some relevance to consider; Wild_Muscle3506 did not get those reward points for nothing. He mentioned that the points were accumulated through his Infinia credit card, and he had spent around ₹15 lakh to build up enough points to make this deal.

Thus, while it came at a deep discount, the same reward balance for the Apple iPhone 16 required significant expenditure to attain. This highlights how powerful credit card reward programs can be when applied correctly.

However, it requires planning and discipline to maximize credit card rewards. In Wild_Muscle3506’s case, it shows that if you manage your spending well and pay off the balance on time, you can unlock serious savings on big-ticket purchases.

For responsible spenders who clear their credit card dues in full each month, rewards programs like HDFC Infinia offer access to some great deals. It’s all about playing the long game and spending smartly.

Conclusion

Wild_Muscle3506 on Apple iPhone 16 is another great example of how credit cards help you save money on premium products if spent smartly. This incurs much spending to reach there, but such is the kind of story that reminds one of how valuable credit card rewards are if managed strategically.

But if you are also a credit card user and use it in ways that let you enjoy its benefits without getting into debt for yourself, then like him, you could start enjoying equally impressive deals in the future.

FAQs:

Q: How did Wild_Muscle3506 get the iPhone 16 for ₹27,000?

A: He used credit card reward points accumulated from his HDFC Infinia credit card to pay the balance after making an initial payment.

Q: What is the original price of the iPhone 16?

A: The iPhone 16 (256GB variant) retails for ₹89,900 in India.

Q: What kind of credit card did the user have?

A: He used the HDFC Bank Infinia Credit Card, a high-end card with premium benefits and reward programs.

Q: Is the HDFC Infinia credit card available to everyone?

A: The HDFC Infinia credit card is a premium product that comes with a high annual fee and is typically offered to high-income earners or those with substantial credit history.

Q: Does spending ₹15 lakh just for credit card points make sense?

A: It depends on your spending habits and whether you can comfortably manage the card’s high annual fee and repay your balance on time. If used responsibly, reward points can offer significant value.

Also Read : Apple iPhone 16 vs iPhone 16 Pro: What Processor Variation Can We Expect?

Also Read : iPhone 16 Sales Meet Expectations, Teen Survey Hints iPhone 16 Upgrades After Apple Intelligence

Also Read : Flipkart UPI’s ₹1 Auto Ride Campaign Creates Buzz in Bengaluru Ahead of Big Billion Day Sale