Highlights

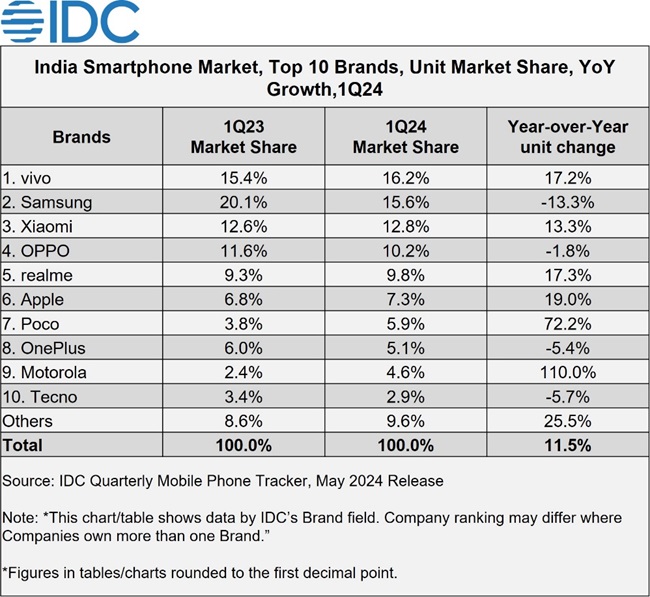

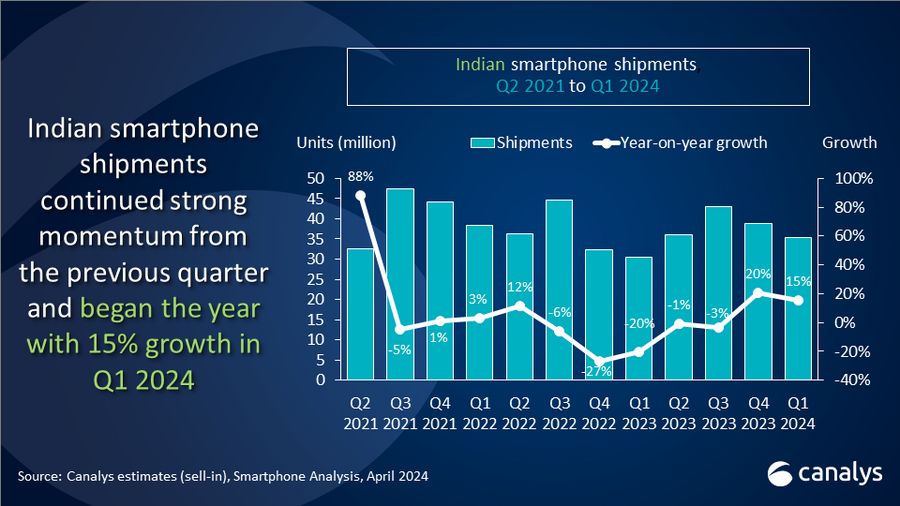

- Indian phone market grew 11.5% in Q1 2024 with 34 million units shipped

- Mass budget segment saw 22% year-on-year growth, capturing 48% market share

- POCO gained 5.9% market share, surpassing OnePlus in shipments

- 5G smartphones comprised 69% of shipments, with a 21% drop in average selling price

The Indian phone market grew 11.5% in Q1 2024, with 34 million units shipped, says IDC.

This marks the third straight quarter of growth.

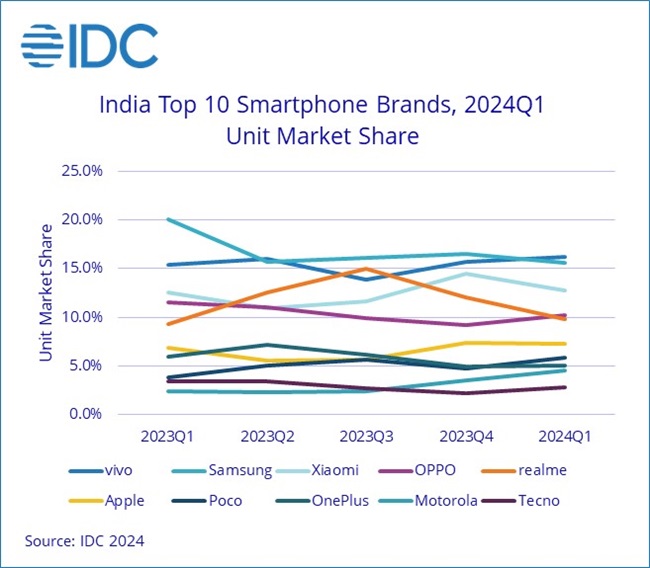

Q4 2023 had a 25% rise in shipments year over year.

“Mass-market brands are prioritizing value-driven strategies in response to sluggish demand growth in the volume-driven segment,” said Chaurasia. “In Q1, brands such as Xiaomi, vivo, and OPPO introduced their latest models – Redmi Note 13, V30, and Reno 11 series – at a higher price compared to the previous generation models. Vendors are aggressively pricing their products to capitalize on the premiumization trend fueled by wider channel access and easy financing options.

Price hikes are expected to continue as operational pressures rise due to higher component costs, despite import duty reductions on a few parts. Brands are also prioritizing channel incentives and retail investments, driving costs up further. This year, brands will look to justify incremental pricing beyond the 5G capabilities. This will be mainly through design language, user experience and other integrated smartphone AIoT offerings.”

“Emphasis on localization in the Indian smartphone ecosystem has become inevitable,” said Chaurasia. “While in 2024 growth catalysts seem to be limited to just 5G device upgrades and premiumization, vendors must focus on long-term strategies for share sustainability.

Amid the government localization push, vendors must further focus on restructuring local distribution, leveraging local manufacturing partners and appointing Indian leadership. Additionally, they need to prioritize enhancing user experience and educating consumers for effective device engagement. Expanding into smaller cities, bolstering mainline retail, and building channel confidence will be crucial.”

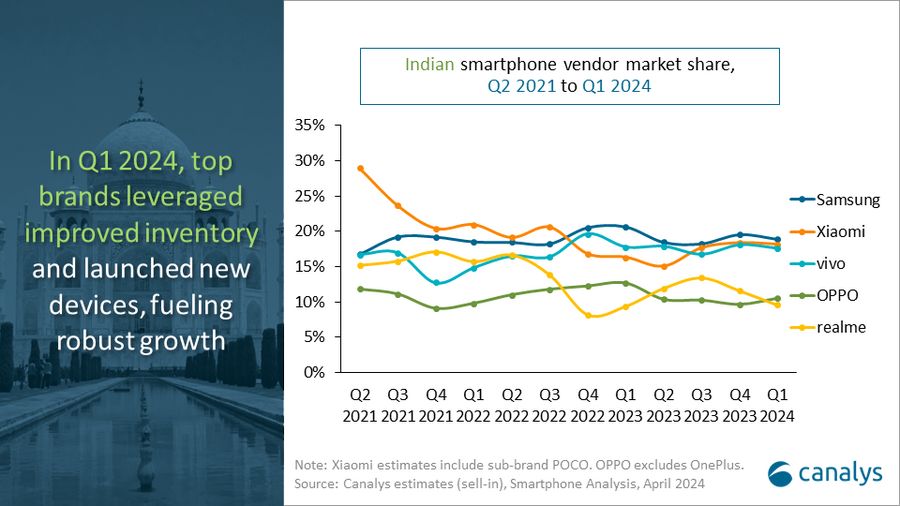

While most brands achieved double-digit growth in Q1, brands outside the top 5 continue to challenge the market share of leading players,” said Canalys Senior Analyst Sanyam Chaurasia. “Vendors’ price correction and promotional strategies towards the end of Q4 2023 assisted inventory management in Q1. Republic Day sales in January accelerated the momentum, with brands leveraging promotions to push their latest offerings. Samsung’s latest flagship Galaxy S24 had a stronger volume than its predecessor, owing to lucrative pre-booking offers on upgrade value, Samsung Finance+ and extensive AI features marketing. Xiaomi saw a robust Q1 resurgence fueled by the Redmi 13C 5G and Redmi Note 13 5G series, along with POCO’s early launch of the X6 series.

OPPO saw a modest decline, having streamlined its portfolio with fewer new releases in the mid-high price ranges. Out of the top 5 – Motorola, Infinix, and Apple achieved high double-digit growth, narrowing the market share gap from top players. Apple’s growth was driven by its cashcow iPhone 15 model which received multiple price cuts and promotional deals on the e-commerce platform.”

“The first few months of the year have provided momentum for the smartphone market in India. However, the second half of the year will be crucial. IDC estimates a modest overall annual growth in the mid-single digits for 2024,” says Navkendar Singh, Associate Vice President, of Devices Research, IDC.

Commenting on the market value dynamics, Senior Research Analyst Shilpi Jain said, “During the quarter, India’s smartphone market reached its highest ever Q1 value. The growth was driven by the strengthening trend of premiumization, with consumers upgrading to higher-value smartphones across price tiers. According to Counterpoint’s Consumer Lens survey, more than one-third of mid-tier consumers are willing to upgrade to the premium segment. Factors driving this trend include affordable financing schemes, better value for trade-ins, and bundled schemes, along with the demand for top-tier features such as AI, gaming, and imaging enhancements.

With a one-fourth share, Samsung led the market in terms of value. Also, at ~$425, Samsung’s ASP was its highest ever, driven by its leading position in the >INR 20,000 segment. This can be attributed to a stronger mix of its newly launched Galaxy S24 series due to its features such as GenAI, and the newly revamped A series, along with the increasing popularity of Samsung’s financing schemes. Apple also had a record quarter in India in terms of value, leading the premium segment both in value and volume terms, driven by the latest iPhone 15 series, especially in offline channels.”

Commenting on the market dynamics, Research Analyst Shubham Singh said, “The onset of 2024 brought a promising start for OEMs, with better inventory levels allowing them to fill channels with multiple new launches. However, sales were less than expected due to a drop in retail footfalls and a section of consumers cutting down on discretionary spending.

During the quarter, vivo captured the top spot by volume for the first time ever, with a 19% share driven by its 5G leadership and CMF (Color, Material, Finish) positioning, along with strong imaging capabilities. Key OEMs focused on diversifying their channel strategies during the quarter, which led to growth in shipments in offline channels, with inventory building up by the end of the quarter.”

Fueling Growth: New Launches and Promotions

A number of launches in smartphones across price bands, coupled with increased promotional activity for premium offerings, marked the quarter.

Brands worked on making the devices more affordable through micro-financing schemes, and e-tailers organized sales with discounting on models nearing their end-of-life stage.

All this helped drive demand and reduce inventories.

“Several new launches across multiple price segments happened during the quarter, coupled with increased promotional activities, particularly around premium offerings. Brands continued their focus on microfinancing schemes to drive affordability. eTailers organized several sales events and offered discounts on models nearing their end-of-life (EOL), resulting in increased demand and lean inventory,” said Upasana Joshi, Senior Research Manager, Client Devices, IDC India.

Market Dynamics: Segments and Brands

- The mass budget segment, which is priced between US$100 and US$200, posted a year-on-year growth of 22%, taking up a 48% share, five percentage points higher than a year ago. Vivo, Xiaomi, and Samsung put together held a 53% share of this segment.

- The entry-premium segment (US$200-US$400) expanded to a 23% market share, growing by 25% year-on-year, with OPPO and Realme accounting for nearly 30% of this segment.

Standout Performer: POCO’s Meteoric Rise

The new IDC report shows POCO has grown fast, hitting a 5.9 percent market share in Q1 2024.

They even beat OnePlus in smartphone shipments.

This growth is due to smart moves.

POCO targets Gen Z with high-performance phones.

They also improve the user experience with strong after-sales service and support.

Mr. Himanshu Tandon, Country Head, POCO India, said in a statement, “POCO’s remarkable progress is a clear reflection of our unwavering dedication to innovation and our deep understanding of our consumers’ needs. As we move forward, we are more determined than ever to maintain this momentum and set new benchmarks in the industry. We owe this milestone to the massive support and love that we have received from our POCO family. We believe that 2024 holds great promise for us.”

5G Smartphones: Gaining Traction

Of these total shipments, 23 million were 5G smartphones, comprising 69% of the market, up significantly from 46% in Q1 2023.

The average selling price for 5G smartphones dropped 21% year on year to US$337 in Q1 2024.

The top shipped 5G models were the Xiaomi Redmi 13C, Vivo T2x, Samsung Galaxy A15, Vivo Y28, and Apple iPhone 14.

Shipments via online channels increased 16% year-on-year and accounted for 51% of total shipments in Q1 2024.

Meanwhile, POCO, Vivo, and Motorola recorded huge year-on-year growth of over 65% in the online channel.

Outlook and Challenges

Though the smartphone market in India saw momentum in the initial months of the year, the second half will be important.

According to IDC, mid–single-digit year-on-year growth is expected in 2024.

However, there is the luring of first-time smartphone users and keeping a check on the impact of the second-hand market.

Moreover, market concentration amongst the top brands is weakening, with smaller brands and sub-brands gaining in volume.

FAQs

What was the growth rate of the Indian phone market in Q1 2024?

The Indian phone market grew by 11.5% in Q1 2024, with 34 million units shipped.

Which segment saw the highest year-on-year growth?

The mass budget segment, priced between US$100 and US$200, posted a 22% year-on-year growth, capturing a 48% market share.

How did POCO perform in Q1 2024?

POCO experienced significant growth, achieving a 5.9% market share and surpassing OnePlus in smartphone shipments.

What percentage of the market did 5G smartphones capture?

In Q1 2024, 5G smartphones accounted for 69% of the market, with 23 million units shipped.

What was the average selling price for 5G smartphones in Q1 2024?

The average selling price for 5G smartphones dropped by 21% year-on-year to US$337 in Q1 2024.

What is Indian smartphone segment wise analysis for Q1 2024 ?

Segment-wise Analysis

Entry-Level Segment (Sub-US$100)

Declined by 14% year-over-year, capturing a 15% market share, down from 20% a year ago.

Xiaomi led this segment, followed by POCO and itel. Mass Budget Segment (US$100<US$200)

Witnessed a 22% year-over-year growth, reaching a 48% market share, up from 44% a year ago.

The top three brands were vivo, Xiaomi, and Samsung, collectively holding 53% of this segment.

Entry-Premium Segment (US$200<US$400)

Expanded to a 23% market share, growing by 25% year-over-year.

OPPO and realme gained significant shares, accounting for nearly 30% of this segment.

Mid-Premium Segment (US$400<US$600)

Experienced a 46% decline in unit terms, representing a 3% market share, down from 6% a year ago.

OnePlus led this segment with a 38% share, followed by vivo and OPPO.

Premium Segment (US$600<US$800)

Held a 2% market share and witnessed a 21% decline in unit terms.

Key models included the iPhone 13, Galaxy S23FE/S23, iPhone 12, and OnePlus12.

Apple’s share declined year-over-year to 45%, while Samsung increased its share to 44%, up from 16% a year ago.

Super-Premium Segment (US$800+)

Recorded the highest growth at 44%, increasing its share from 7% to 9%.

The iPhone14/15/14 Plus/15 Plus dominated this segment with a 64% share, followed by the Galaxy S24/S24 Ultra/S23/S24+ with a 25% share.

Apple led the segment with a 69% share, followed by Samsung at 31%.

What are the 5G Smartphone Trends for Indian Smartphone Market ?

Out of the total shipments, 23 million were 5G smartphones, constituting 69% of the market. This reflects a significant rise from 46% in 1Q23.

The average selling price (ASP) of 5G smartphones decreased by 21% YoY to US$337 in 1Q24.

Within the 5G category, the mass budget segment (US$100<US$200) observed a threefold growth, capturing a 46% market share.

Top shipped 5G models included Xiaomi’s Redmi 13C, vivo’s T2x, Samsung’s Galaxy A15, vivo’s Y28, and Apple’s iPhone 14.

What is Brand wise Performance for India Smartphone Market ?

POCO exhibited remarkable YoY growth of 72.2% in Q1 2024, securing a 5.9% market share and surpassing OnePlus in shipments.

vivo emerged as the leading brand, overtaking Samsung, with a diverse product portfolio across price segments and distribution channels.

Motorola registered the highest growth among the top 10 brands, primarily driven by affordable launches.

Apple witnessed a 19% YoY growth in shipments, with iPhone 14/15 constituting 56% of total shipments.

Also Read: Indian Smartphone Market Experiences Significant Growth in Early 2024: Canalys

Also Read: Apple Overtakes Samsung in Global and European Smartphone Markets in 2023