Highlights

- iPhone 15 Pro Max leads with 40-45% of total iPhone 15 shipments in early 2024.

- Specialized tetraprism lens boosts Largan’s revenue by up to NT$3.8 billion.

- Apple slashes iPhone prices by up to 500 yuan in China’s competitive market.

- Online retailers like Pinduoduo offer up to 16% discount on iPhone 15 models.

Renowned for its premium features, the iPhone 15 Pro Max’s sales are notably beneficial to Apple’s camera lens supplier, Largan, according to TF Securities analyst Ming-Chi Kuo.

In his analysis, Kuo anticipates that the iPhone 15 Pro Max will account for 40-45% of total iPhone 15 shipments in this period.

The model’s specialized tetraprism lens arrangement is expected to significantly boost Largan’s revenue, potentially contributing to a 20-25% year-over-year growth.

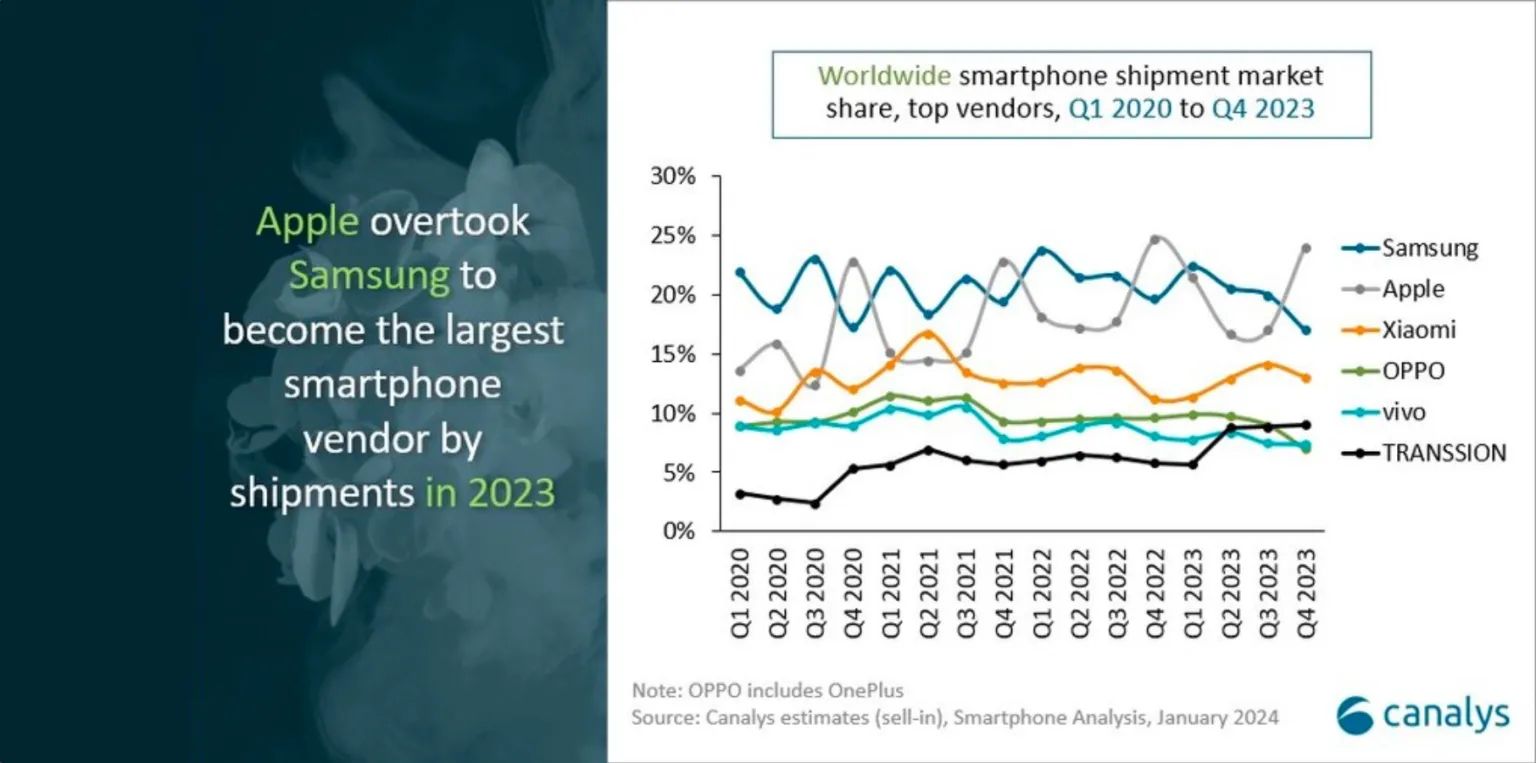

“The top two players are eagerly looking for new growth drivers for their smartphone businesses as both suffered market share declines in Q4,” said Canalys Research Manager Amber Liu. “In 2023, Samsung focused on the mid-to-high-end segment for profitability but lost share in the low-end segment and also its leading position in the global market. Its 2024 product launches, especially in the high-end segment with a focus on on-device AI (see Canalys blog: “On-device AI and Samsung’s role in the future smart ecosystem race”), will support its rebound as an innovation leader in 2024.”

“Apple showed resilience over the past two years, thanks to solid ongoing demand in the high-end segment. The expanded positioning of its iPhone 15 series has pointed to the future direction of Apple’s portfolio strategy to reach a broader range of consumer segments,” said Liu. “But Huawei’s improving strength and looming local competition in mainland China will challenge Apple to sustain its growth trajectory in mainland China while high-end replacement demand in other major markets, such as North America and Europe, is leveling off. Apple must look to new market growth and ecosystem strength to reinvigorate its iPhone business.”

High Sales Impact on Supply Chain

The financial success of the iPhone 15 Pro Max, particularly its advanced camera technology, is critical to Largan’s off-season financial results.

The supplier could see an increase in revenue by NT$3.4 billion to NT$3.8 billion ($108.8 million to $121.7 million) due to this model alone.

Apple’s Strategy in China

In the competitive Chinese market, Apple has taken a rare step of reducing iPhone prices, offering discounts of up to 500 yuan ($70) as part of a Lunar New Year promotion.

This strategy comes amid growing competitive pressure and a noticeable drop in iPhone 15 series sales in China.

Jefferies analysts report a 30% decline in Chinese iPhone sales in the first week of 2024 compared to the same period in the previous year.

Despite not raising prices for the iPhone 15 series at its September launch, Apple faces stiff competition from local brands and restrictions in certain sectors.

iPhone 15 Series: Price Slashed in China

Major online retailers like Pinduoduo have initiated significant price reductions for Apple’s latest offerings, the iPhone 15 and iPhone 15 Pro.

These adjustments, which see prices slashed by up to 16%, are a clear response to the shifting consumer demands and the need to maintain a competitive edge in the global smartphone market.

Apple’s high-end smartphones, while popular, face stiff competition from a variety of other brands offering similar features at potentially lower price points.

Huawei is slowly gaining a lot of steam with its audience in China, hurting Apple sales.

By adjusting prices, these online platforms are not only boosting sales but also ensuring that Apple products remain within reach for a broader consumer base.

More importantly, though, these price reductions are Apple’s way of recognising the importance of e-commerce platforms in driving sales.

In an era where online shopping has become increasingly prevalent, competitive pricing on these platforms is essential to capture the attention of digital-savvy consumers.

APPLE IPHONE 15 PRO MAX SPECIFICATIONS

Key Specs

| RAM | 6 GB |

| Processor | Apple A15 Bionic |

| Rear Camera | 12 MP + 12 MP + 12 MP |

| Front Camera | 12 MP |

| Battery | 4400 mAh |

| Display | 6.7 inches (17.02 cm) |

General

| Launch Date | August 16, 2023 (Unofficial) |

| Operating System | iOS v15 |

Performance

| Chipset | Apple A15 Bionic |

| CPU | Hexa Core (3.23 GHz, Dual core, Avalanche + 1.82 GHz, Quad core, Blizzard) |

| Architecture | 64 bit |

| Fabrication | 5 nm |

| Graphics | Apple GPU (four-core graphics) |

| RAM | 6 GB |

Display

| Display Type | OLED |

| Screen Size | 6.7 inches (17.02 cm) |

| Resolution | 1284 x 2778 pixels |

| Aspect Ratio | 19.5:9 |

| Pixel Density | 457 ppi |

| Screen Protection | Yes |

| Bezel-less display | Yes |

| Touch Screen | Yes, Capacitive Touchscreen, Multi-touch |

| Refresh Rate | 120 Hz |

Design

| Waterproof | Yes, Water resistant, IP68 |

| Ruggedness | Dust proof |

Camera

| MAIN CAMERA | ||

| Camera Setup | Triple | |

| Resolution | 12 MP f/1.6, Wide Angle, Primary Camera 12 MP , Telephoto Camera 12 MP, Ultra-Wide Angle Camera |

|

| Autofocus | Yes | |

| Flash | Yes, Dual LED Flash | |

| Image Resolution | 4000 x 3000 Pixels | |

| Settings | Exposure compensation, ISO control | |

| Shooting Modes | Continuous Shooting High Dynamic Range mode (HDR) |

|

| Camera Features | Digital Zoom Auto Flash Face detection Touch to focus |

|

| Video Recording | 1920×1080 @ 30 fps | |

| FRONT CAMERA | ||

| Camera Setup | Single | |

| Resolution | 12 MP f/2.3, Primary Camera | |

| Video Recording | 1920×1080 @ 30 fps | |

Battery

| Capacity | 4400 mAh |

| Type | Li-ion |

| Removable | No |

| Quick Charging | Yes, Fast |

| USB Type-C | No |

Storage

| Internal Memory | 128 GB |

| Expandable Memory | No |

Network & Connectivity

| SIM Slot(s) | Dual SIM, GSM+GSM |

| SIM Size | SIM1: Nano, SIM2: eSIM |

| Network Support | 5G Not Supported in India, 4G Supported in India, 3G, 2G |

| VoLTE | Yes |

| SIM 1 |

4G Bands:

TD-LTE 2300(band 40)

FD-LTE 1800(band 3) 3G Bands:

UMTS 1900 / 2100 / 850 / 900 MHz

2G Bands:

GSM 1800 / 1900 / 850 / 900 MHz

GPRS:

Available

EDGE:

Available

|

| SIM 2 |

4G Bands:

TD-LTE 2300(band 40)

FD-LTE 1800(band 3) 3G Bands:

UMTS 1900 / 2100 / 850 / 900 MHz

2G Bands:

GSM 1800 / 1900 / 850 / 900 MHz

GPRS:

Available

EDGE:

Available

|

| Wi-Fi | Yes, Wi-Fi 4 (802.11 b/g/n) |

| Wi-Fi Features | Mobile Hotspot |

| Bluetooth | Yes, v5.0 |

| GPS | Yes with A-GPS, Glonass |

| NFC | Yes |

Multimedia

| FM Radio | No |

| Loudspeaker | Yes |

| Audio Jack | Lightning |

Sensors

| Fingerprint Sensor | No |

| Other Sensors | Light sensor, Proximity sensor, Accelerometer, Barometer, Compass, Gyroscope |

What was Apple’s market share in the premium smartphone segment in 2023?

In 2023, Apple held a dominant 71% share in the premium smartphone market, a slight decrease from 75% in the previous year, showcasing its continued market leadership.

What was the impact of Huawei’s comeback in the premium smartphone market?

Despite facing sanctions, Huawei made a significant comeback in 2023, increasing its market share to 5%, up from 3%, indicating a shift in consumer preferences and the brand’s resilience.

What caused the recent decline in Apple’s stock value?

Apple’s stock recently experienced a 3.6% decline, closing at 185.64, primarily due to analyst concerns about the demand for the upcoming iPhone 16 and the overall market outlook for Apple in 2024.

What changes did Barclays analyst Tim Long make to Apple’s stock rating?

Tim Long, an analyst from Barclays, downgraded Apple’s stock from ‘equal weight’ to ‘underweight’, also reducing the price target from 161 to 160.

Also Read: Apple Leads Global Premium Smartphone Market with Huawei’s Remarkable Comeback in 2023: Counterpoint

Also Read: Apple Shares Dip Amid Concerns Over iPhone 16 Demand and Market Outlook

Also Read: Apple To Reportedly Expand iPhone Manufacturing Operations in India to 50 Million Units A Year

Also Read: Apple Again Reaches Fabled $3 Trillion Market Cap Amid Varied Market Performance