Highlights

- MediaTek ships 117 million units, leading the Q4 2023 market.

- Achieved 21% YoY growth in shipments and 22% increase in revenue.

- Samsung opts for MediaTek and Qualcomm chips amid Exynos’ 44% revenue drop.

- Unisoc displays 24% YoY growth, driven by partnerships with budget smartphone brands.

MediaTek has emerged as the clear leader in the final quarter of 2023, according to the latest insights from Canalys.

While the chipset market includes heavyweights like Apple, Google, Qualcomm, Unisoc, and Samsung, MediaTek distinguished itself not just in terms of units shipped but also in its remarkable year-on-year growth.

Dominating the Market with Impressive Growth

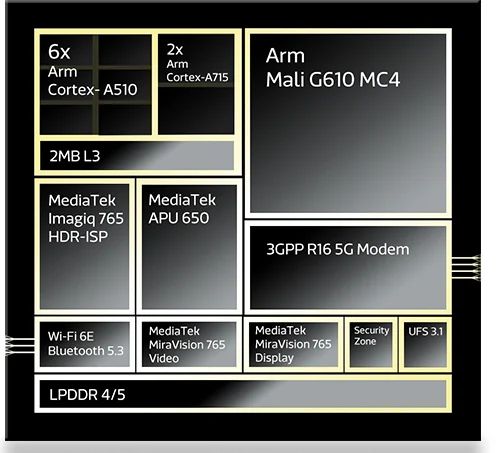

MediaTek, the Taiwanese semiconductor company, has made waves with the launch of the Dimensity 9300 series.

The Q4 2023 report by Canalys reveals that MediaTek successfully shipped an impressive 117 million units, far outpacing Apple’s 78 million and Qualcomm’s 69 million.

This not only showcases MediaTek’s dominance in terms of volume but also its substantial 21% year-on-year growth in shipments, alongside a 22% increase in revenues to $23 billion.

Despite this monumental achievement, MediaTek’s financial gains still fell short of its competitors, with Apple generating a staggering $87 billion and Qualcomm $30 billion in revenue over the same period.

Nonetheless, MediaTek’s performance is noteworthy, especially when contrasted with Samsung’s Exynos brand, which saw a 44% plunge in its earnings, hinting at a preference for MediaTek and Qualcomm chips in Samsung devices during the quarter.

Market Dynamics and Rising Stars

Xiaomi emerged as Qualcomm’s largest buyer in Q4 2023, accounting for 25% of its shipments.

In contrast, Samsung was MediaTek’s biggest customer, despite the wide reach of MediaTek’s chips across various brands including Xiaomi, Vivo, and OPPO.

An interesting subplot in the report is the performance of Unisoc, a company that exhibited a robust 24% year-on-year growth in both revenues and shipments, albeit from a smaller base.

Unisoc’s success is predominantly attributed to partnerships with Transsion brands, alongside Realme and Lenovo, indicating a strong presence in the budget smartphone sector.

Google’s Tensor chips, exclusive to the Pixel series, showed relatively modest shipments and revenue, reflecting the niche market share of Pixel smartphones.

Huawei, on the other hand, recorded an astronomical 5,121% growth in shipments, a remarkable comeback attributed to its new Kirin chips, signaling Huawei’s resilience in the face of adversity.

FAQs

How many units did MediaTek ship in Q4 2023?

MediaTek led the market with 117 million units shipped in the last quarter of 2023, surpassing both Apple and Qualcomm.

What was MediaTek’s year-on-year growth in Q4 2023?

MediaTek’s shipments grew by 21% year-on-year, with revenues increasing by 22% to $23 billion during the same period.

Which company was the largest buyer of Qualcomm chipsets in Q4 2023?

Xiaomi was the largest buyer of Qualcomm chipsets, accounting for 25% of Qualcomm’s total shipments in Q4 2023.

How did Unisoc perform in the Q4 2023 market?

Unisoc saw a 24% year-on-year growth in both revenues and shipments, largely thanks to its collaboration with budget smartphone manufacturers like Transsion brands, Realme, and Lenovo.

What contributed to Huawei’s significant growth in Q4 2023?

Huawei experienced a dramatic 5,121% growth in shipments, attributed to the launch of its new Kirin chips, marking a strong return to the chipset market.

Also Read: MediaTek Set to Unveil Flagship Dimensity 9400 SoC in Q4: Expected Features and More

Also Read: MediaTek’s Dimensity 9300 Soars in 2023, Paves Way for Next-Gen Dimensity 9400

Also Read: MediaTek Unveils T300 Platform for Enhanced IoT Connectivity at MWC 2024