Highlights

- Reliance advocates for an auction-based process for satellite broadband spectrum.

- This opposes the administrative allocation suggested by TRAI.

- Conflict is leading to a clash with Musk’s Starlink.

- TRAI is conducting a public consultation on spectrum allocation.

- Deloitte forecasts 36% annual growth for India’s satellite broadband market.

Reliance is reportedly pushing for a spectrum auction for home satellite broadband instead of a government allocation.

The reports are coming after the telecom regulator suggested that the spectrum for home satellite broadband should be allocated by the government and not auctioned.

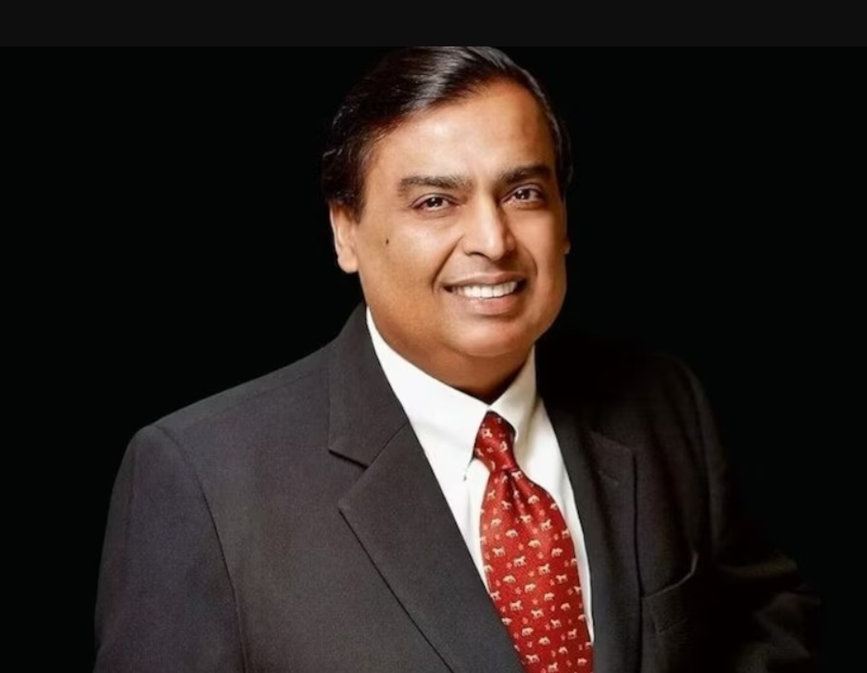

This is now being looked at as a clash between Mukesh Ambani’s Reliance and Elon Musk’s Starlink.

The controversy over how to allocate spectrum for satellite services in India has been brewing since last year.

Many global giants such as Musk’s Starlink and Amazon’s Project Kuiper have supported the idea of administrative allocation. However, it is now clear that home-grown Reliance is advocating for an auction-based process.

The issue is about how we interpret Indian laws.

According to a recent Reuters report, some experts believe that the spectrum allocation of last aligns with what Musk has been proposing. However, Reliance has continuously maintained that there are no existing provisions for satellite broadband services.

As per a Business Today report, the Telecom Regulatory Authority of India (TRAI) is currently conducting a public consultation on the matter.

Reliance has called for the process to be restarted in a private letter dated October 10. The home-grown conglomerate claimed that TRAI has pre-emptively interpreted the situation in favour of allocation.

“TRAI seems to have concluded, without any basis, that spectrum assignment should be administrative,” wrote Kapoor Singh Guliani Reliance’s senior regulatory affairs official, in a letter to Telecom Minister Jyotiraditya Scindia.

On the other hand, the TRAI consultation paper suggested that Indian laws mandate administrative allocation of spectrum. A senior TRAI official reportedly stated that a due process is being followed. The official also encouraged Reliance to submit its feedback during the consultation period.

The outcome of TRAI’s recommendations will play a major role in shaping the government’s decision on spectrum allocation.

Reliance’s letter to Telecom Minister Jyotiraditya Scindia has not been made public.

Deloitte predicts that India’s satellite broadband market could grow by 36% annually. This has the potential to reach $1.9 billion by 2030.

Meanwhile, Musk’s Starlink is eager to launch in India, but unresolved issues around spectrum allocation are slowing progress.

Starlink favours administrative licensing and have argued that it’s in line with global practices. On the other hand, Reliance insists that auctions are critical to maintaining a level playing field, especially as foreign competitors may enter the Indian voice and data services market.

Reliance Jio currently leads the telecom sector in India with 480 million users.

Reliance has written a formal request to Minister Scindia on auctioning the satellite spectrum.

It also suggested reissuing TRAI’s consultation paper to ensure fair competition between satellite communications and traditional networks.

Jio has highlighted that several global satellite constellations including Starlink and Amazon Kuiper are seeking spectrum and market access in India. These companies aim to offer services that could compete directly with traditional mobile and fixed wireless networks.

“Given that terrestrial networks acquire spectrum through auctions for mobile and fixed wireless access, a fair and transparent auction system for satellite services is essential for level competition,” Jio stated.

This letter follows an earlier request to TRAI chairman AK Lahoti, in which Jio sought revisions to the consultation paper on spectrum pricing, arguing that the issue of a level playing field has been overlooked.

The Broadband India Forum (BIF), whose members include OneWeb and Amazon, dismissed Jio’s concerns, claiming that the call for a level playing field reflects a misunderstanding of both technology and the law.

In its recent letter, Jio pointed out that the Department of Telecommunications (DoT) had previously referenced the need for fairness when consulting TRAI. However, Jio feels that the regulator has not addressed this vital issue.

“We respectfully request your intervention so TRAI addresses these issues in its consultation paper and ensures that its recommendations on spectrum assignment uphold fairness, transparency, and competition as mandated by the Telecommunications Act and Supreme Court rulings,” Jio urged.

Jio also noted that the DoT has not specified a method for spectrum assignment, leaving the issue open for discussion under Section 4 of the Telecommunications Act.

“TRAI seems to have concluded, without any basis, that spectrum assignment should be administrative and based on a ‘first-come, first-served’ approach,” Jio stated.

FAQs

Q1. What does Reliance want for the home satellite broadband spectrum?

Answer. Reliance advocates for an auction-based process for satellite broadband spectrum, opposing the government’s preference for administrative allocation.

Q2. What is the purpose of TRAI’s public consultation on spectrum allocation?

Answer. TRAI is conducting a public consultation on spectrum allocation, and Reliance urges a restart, citing fairness and competition, particularly against foreign competitors.

Q3. What are Deloitte’s forecasts for India’s satellite broadband market?

Answer. Deloitte forecasts 36% annual growth for India’s satellite broadband market, potentially reaching $1.9 billion by 2030, highlighting the market’s significance.

Also Read : Reliance Jio Announced ISD Packs Starting Rs. 39 for Prepaid and Postpaid Users

Also Read : Reliance Industries Gears Up for 46th AGM: What to Expect

Also Read : Elon Musk’s Starlink Direct-to-Cell Communication