Highlights

- Google Pay offers user-friendly interface and innovative payment options like UPI Lite.

- PhonePe leads with a vast merchant network and wallet feature for easy refunds.

- Amazon Pay integrates seamlessly with Amazon for a unified shopping experience.

- BHIM app provides government-backed security and supports multiple Indian languages.

The RBI had mandated Paytm Payments Bank last month to halt accepting fresh deposits and contemplate business operation suspension, citing non-compliance issues.

This has led to a significant market value loss, impacting Paytm’s core business and credibility.

Naturally, people are wondering what are the other alternatives to Paytm. Below we have listed 10 UPI apps that you can do secure transactions with.

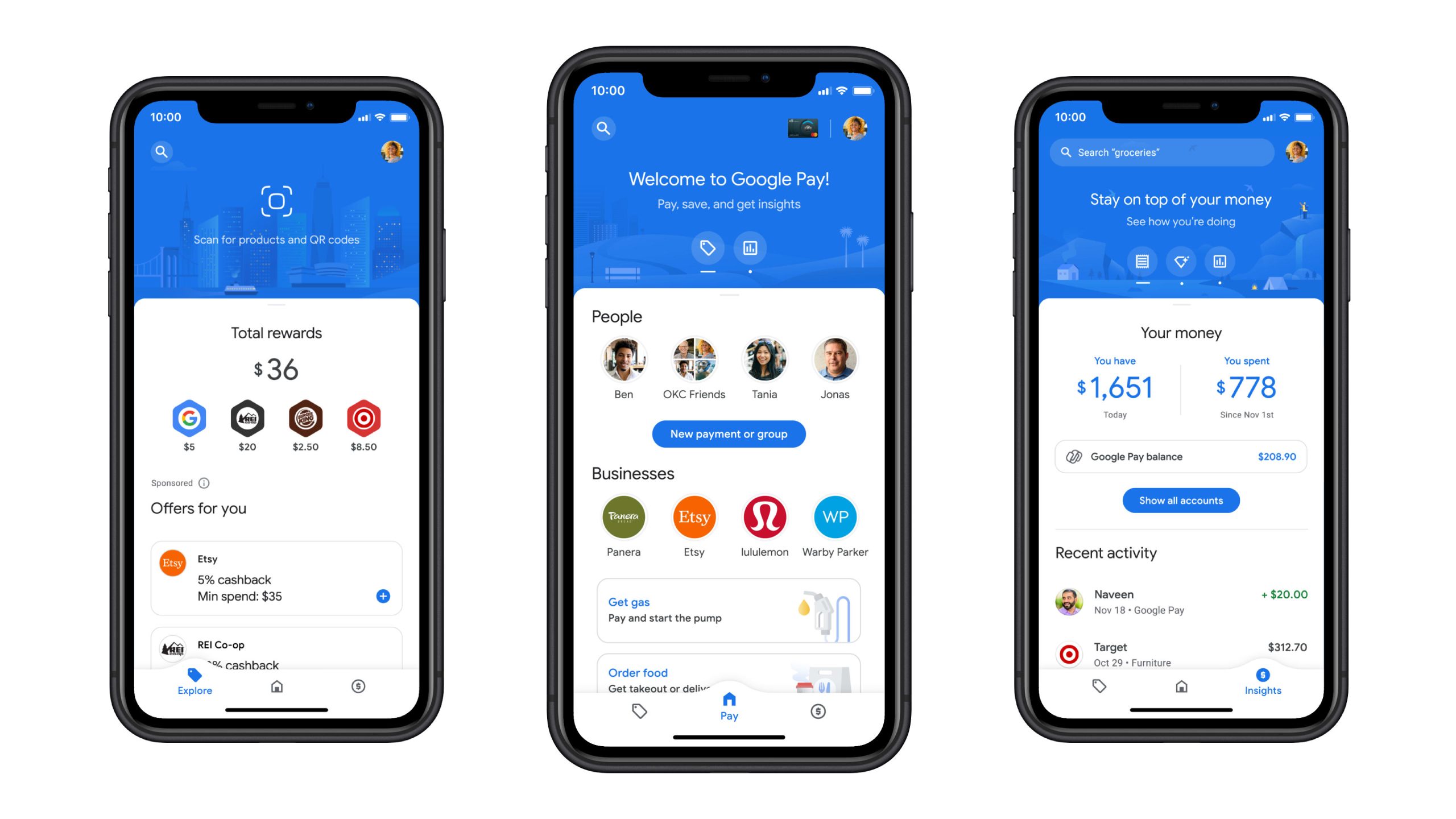

Google Pay

Google Pay is a digital wallet platform and online payment system developed by Google to power in-app and tap-to-pay purchases on mobile devices, enabling users to make payments with Android phones, tablets, or watches.

It also allows peer-to-peer transactions between individuals. In addition, Google Pay uses near field communication (NFC) to transmit card information facilitating funds transfer to the retailer.

Pros:

- User-friendly interface, making it easy for new users to navigate.

- Offers rewards like cashback and discount coupons, enhancing user engagement.

- Supports innovative payment options such as UPI Lite and NFC for tap-and-pay.

- Pre-installed on Android devices, ensuring wide accessibility.

Cons:

- Some users may experience delays in receiving rewards.

- Might not offer as extensive merchant-specific deals as some other platforms.

PhonePe

PhonePe is a digital payment platform that allows users to make seamless and secure payments from their smartphones.

It provides a range of services from mobile recharges to bill payments.

It also offers services like mutual funds and insurance, and allows users to invest in gold and shop for products across multiple categories.

Pros:

- Market leader with a vast user base, offering reliability and trust.

- Wallet feature allows for quick refunds and easy balance management.

- Extensive merchant network for bill payments, recharges, and online shopping.

- Offers investment options in mutual funds and gold.

Cons:

- The app’s extensive feature set may overwhelm new users.

- Occasional app performance issues during peak transaction times.

Amazon Pay

Amazon Pay is an online payment processing service owned by Amazon.

It provides a single view of your orders and transactions, allows you to shop from thousands of merchants, and helps you keep track of your shopping, orders, and shipments.

It also offers features like instant checkout, balance tracking, faster balance refund, and adding Gift Card balance to your account.

Pros:

- Integrated with Amazon, offering a seamless shopping and payment experience.

- Accumulates cashback and rewards directly in the wallet, usable across Amazon.

- Supports a broad range of services including bill payments and UPI transactions.

Cons:

- Primarily benefits Amazon customers, might not be the primary choice for non-Amazon users.

- Wallet balance cannot be withdrawn to a bank account.

BHIM App

BHIM (Bharat Interface for Money) is a mobile app developed by the National Payments Corporation of India based on the Unified Payment Interface (UPI).

It facilitates e-payments directly through banks and drives towards a cashless society.

The app supports all Indian banks that use UPI, which is built over the Immediate Payment Service (IMPS) infrastructure and allows the user to instantly transfer money between bank accounts of any two parties.

Pros:

- Government-backed, ensuring high security and reliability.

- Minimalist design, easy to use for basic UPI transactions and bill payments.

- Supports multiple languages, making it accessible to a wider audience.

Cons:

- Lacks some of the advanced features and rewards offered by private competitors.

- User experience may not be as polished as in other apps.

CRED

CRED is a members-only app that offers exclusive rewards for every credit card bill payment.

It provides a platform for users to manage all their credit cards in one place and win rewards on every credit card bill payment.

It also provides insights about your spending patterns, helping you manage your finances better.

Pros:

- Focuses on credit card payments, offering rewards and cashbacks for timely payments.

- Allows management of multiple credit cards in one place.

- Offers exclusive deals and discounts on premium brands.

Cons:

- Limited to credit card users, not a comprehensive digital wallet solution.

- Rewards primarily cater to high-spending users.

JioMoney Wallet

JioMoney Wallet is a digital wallet offered by Reliance Jio.

It offers a range of digital services like fast and secure online recharges and bill payments, sending/receiving money, making payments at local stores, and many more.

It also provides a secure way to store your documents and cards digitally.

Pros:

- Offers a range of services including recharges, bill payments, and ticket bookings.

- Provides cashback and rewards, enhancing user value.

- No bank account needed for recharging the JioMoney wallet.

Cons:

- Mainly designed for Jio users, with some features restricted to them.

- Accepted at a limited number of merchants outside the Reliance ecosystem.

MobiKwik

MobiKwik is a digital wallet and online payment system where a user can store money to make mobile and DTH recharge, pay utility bills, and shop at various online merchants.

MobiKwik wallet can also be used for transferring money to other MobiKwik wallets and bank accounts.

Pros:

- Offers a ‘Zip’ pay-later feature, providing users with a short-term credit option.

- Extensive cashback and rewards system, encouraging regular use.

- Supports a wide range of services including bill payments, recharges, and money transfers.

Cons:

- The interface may seem cluttered due to the multitude of features.

- Cash pick-up service limited to select cities.

Freecharge

Freecharge is a digital marketplace for financial services.

With Freecharge, you can do online recharges, make donations, do utility bill payments, invest in mutual funds, get easy credit, and much more.

It also provides a platform for users to manage all their bills and payments in one place.

Pros

- Instant notifications for transactions, keeping users informed.

- Provides a smooth and quick payment experience with minimal steps.

- Offers a pay-later option for seamless transactions.

Cons

- Cashback and rewards are not as competitive as some other platforms.

- Some users report issues with customer service responsiveness.

Airtel Thanks

Airtel Thanks is an exclusive rewards program for Airtel customers.

It offers a variety of benefits such as exclusive offers, premium content, e-books, device protection, and more.

It also provides a platform for users to manage all their Airtel services in one place.

Pros:

- Integrated services for Airtel users including bill payments, recharges, and banking.

- Offers exclusive Airtel rewards and benefits.

- Allows opening of Airtel Payments Bank accounts directly through the app.

Cons:

- Primarily beneficial for Airtel users, offering limited advantages to others.

- Some services within the app may require additional verification steps.

BharatPe

BharatPe is a QR code-based payment app for offline retailers and businesses.

It allows merchants to accept payments from any UPI app like Paytm, PhonePe, Google Pay, etc.

It also provides a platform for merchants to manage all their payments and customers in one place.

Pros:

- Tailored for merchants, allowing acceptance of payments from all UPI apps without fees.

- Offers instant loan facilities to merchants based on transaction history.

- Simple and easy-to-use interface for business transactions.

Cons:

- Focused more on merchants than on consumer usage.

- Limited appeal for regular users not engaged in business.

FAQs

What makes Google Pay a preferred choice for UPI transactions?

Google Pay simplifies transactions with its user-friendly interface and rewards system, including cashback and coupons, making it a popular choice for Android users.

How does PhonePe enhance the digital payment experience?

PhonePe offers a comprehensive digital payment platform with a wide range of services, including bill payments, recharges, and online shopping, backed by a large user base for trust and reliability.

Can Amazon Pay be used for transactions outside of Amazon?

Yes, Amazon Pay extends its services beyond Amazon purchases, supporting bill payments, UPI transactions, and offering cashback on a wide array of services.

What are the advantages of using the BHIM app for UPI transactions?

The BHIM app stands out for its security features, government backing, and support for multiple languages, making it accessible and reliable for a broad audience.

Is there any fee associated with using these UPI apps for transactions?

Most UPI apps offer fee-free transactions for users, making them a cost-effective choice for digital payments. However, certain transactions like money transfers to bank accounts may incur nominal charges depending on the app and the specific transaction type.

Can I use multiple UPI apps with the same bank account?

Yes, you can link the same bank account to multiple UPI apps. This flexibility allows users to take advantage of different features and rewards offered by various apps while managing transactions from a single account.

How do UPI apps ensure the security of transactions?

UPI apps implement several layers of security, including device binding, two-factor authentication, and encryption, to protect user data and transactions. Regular audits and compliance with RBI guidelines further enhance transaction security.

What happens to Paytm FASTag after RBI’s directive?

Following the RBI’s instruction, Paytm Payments Bank will cease operations, impacting FASTag services. Users are advised to close their Paytm FASTag accounts and switch to another provider before the February 29, 2024 deadline.

How can I close my Paytm FASTag account?

You can close your Paytm FASTag account by calling Paytm customer service or through the Paytm app. Follow the steps provided in the app or give the necessary information to customer service to initiate closure.

Where can I find a new FASTag provider?

A comprehensive list of authorized NETC FASTag issuers is available for users looking to switch from Paytm. Choose a bank from the list and open a new FASTag account with them.

What is required to update FASTag KYC?

To update your FASTag KYC, visit the official FASTag portal or your new provider’s website, log in, and submit the required ID and address proof documents in the “KYC” section under “My Profile.”

How to steps to close your Paytm FASTag account?

Open the Paytm app on your phone and click on the search icon (magnifying lens) on top.

Type FASTag in the search bar and click on the Manage Fastag option under the Paytm Payments Bank header.

You will see all FASTag accounts associated with the Paytm account. Tap on the ones you want to deactivate on the next page where Management Options are displayed.

To close a FASTag account, scroll to the bottom of the page showing all FASTag accounts and click on Help & Support.

Scroll to the bottom again and select Need help with non-order-related queries.

On the next page, select I want to close my FASTag and select the FASTag VRN.

You will see the Close FASTag button on the next page at the bottom, click on it.

Permit to open a web browser and select the VRN on the page that opens in the browser.

Select the appropriate reason for closing from the list (It will be service-related issues with my FASTag in this case.)

Click on Close FASTag.

Once you have finished the above steps, Paytm will inform you that the account will be closed in 5-7 business days and the security deposit of Rs 250 along with the FASTag balance will be refunded to the Paytm Wallet.

Do remember that once you deactivate your Paytm FASTag account, you cannot reactivate it and will have to open a new account.

How to Port From Paytm FASTag?

There is currently no system in place to port from one FASTag provider to another.

However, Paytm FASTag users can deactivate their accounts using the steps above and open a new FASTag account with their bank. Below is the complete list of the NETC FASTag providers in India.

AU Small Finance Bank

Axis Bank Ltd

Bandhan Bank

Bank of Baroda

Bank of Maharashtra

Canara Bank

Central Bank of India

City Union Bank Ltd

Cosmos Bank

Dombivli Nagari Sahakari Bank

Equitas Small Finance Bank

Federal Bank

FINO Payments Bank

HDFC Bank

ICICI Bank

IDBI Bank

IDFC First Bank

Indian Bank

Indian Overseas Bank

IndusInd Bank Ltd.

Jammu and Kashmir Bank

Karnataka Bank

Karur Vysya Bank

Kotak Mahindra Bank

Nagpur Nagarik Sahakari Bank

Punjab National Bank

Saraswat Bank

South Indian Bank

State Bank of India

The Jalgaon People Co-op Bank

Thrissur District Cooperative Bank (Kerala Bank)

UCO Bank

Union Bank of India

Yes Bank Ltd

LivQuik/QuikWallet

How to check FASTag KYC status?

To check your FASTag KYC status:

Visit .

Log in using your registered mobile number and password, or opt for OTP-based validation.

Navigate to the Dashboard Menu, select “My Profile,” and view your KYC status.

How to update FASTag KYC?

Visit and log in with your registered mobile number and password or OTP.

In the Dashboard Menu, choose “My Profile” and click on the ‘KYC’ sub-section.

Select “Customer Type” and complete the mandatory fields by submitting the required ID Proof and Address Proof documents.

Tick the declaration confirming document authenticity to proceed with the KYC verification process.

How to Update KYC for FASTags from Specific Banks?

Visit .

Under “Request for NETC FASTag,” select your FASTag issuer bank and visit the bank’s website.

Log in to the respective FASTag issuer bank.

Update KYC online.

Note: The KYC takes about 7 working days to get approved.

What are the RBI’s restrictions on Paytm Payments Bank?

The RBI has prohibited Paytm Payments Bank from onboarding new customers, accepting fresh deposits, and conducting debit or credit transactions through wallets, FASTags, and NCMC cards.

How will Paytm’s operations change in response to RBI’s directive?

Paytm’s parent company, One97 Communications, announced a strategic shift to work with various banks other than Paytm Payments Bank. This move aims to comply with RBI’s directives while continuing its payment and financial services.

What is the impact on Paytm Fastag and NCMC card users?

Users of Paytm Fastag are advised to purchase a new tag from other issuers as the existing tags will be deactivated. NCMC card users can use the existing balance but cannot infuse new funds after February 29.

Will Paytm UPI services be affected by the RBI’s restrictions?

The impact on Paytm UPI services is not entirely clear. UPI transactions linked to external bank accounts might still be operational, but those linked to Paytm Payments Bank might face disruptions.

Are mutual fund investments and SIPs via Paytm affected by these restrictions?

Mutual fund investments and SIPs via Paytm, managed by Paytm Money regulated by SEBI, are not expected to be affected by the RBI’s action on Paytm Payments Bank.

What are Advantages of Online Payment Apps ?

Allows contactless payments so users don’t have to deal with the hassle of cash or cards.

Digital payments are faster and more efficient.

Payment apps use data encryption or protected code systems to safeguard the personal information of users. Ways like PIN, fingerprint, etc. are used to add an extra layer to security.

The recurring payment option allows the user to set up automatic payments for tasks that are regular. This way tracking finances is easier.

E-payments are transparent as every detail about the transaction is stored in the system.

What are the disadvantages of Online Payment Apps?

Cybercriminals manipulate users, obtain private information, and rob people of their money.

Technical glitches like server down, bugs, and other network issues are common.

Online payment apps are dependent on the internet. If you live in remote areas or don’t have access to the internet, it might pose problems.

What is UPI?

Unified Payment Interface (UPI) is a platform developed by the National Payments Corporation of India (NPCI) under the guidelines of the Reserve Bank of India (RBI). It enables real-time money transfers between bank accounts using a Virtual Payment Address (VPA) instead of traditional IFSC codes. UPI has revolutionized the way we handle financial transactions, making them faster, safer, and more convenient.

What are the Key Features of Google Pay ?

AutoPay Feature: Provides a facility to auto-recharge or pay for monthly subscriptions for OTT apps.

UPI Lite: UPI lite can be used to initiate transactions of small amounts without the security pin.

CIBIL Score: Users can check their CIBIL score easily for free.

What are Key Features of PhonePe ?

UPI International: It allows users to make international transactions. Currently accepting countries – Bhutan, Singapore, Nepal, UAE, and Mauritius.

UPI payments with Credit Cards: Usually, UPI payments with credit cards are not supported. But using this feature, we can make payments using Rupay Credit Cards.

Cashbacks on One Tap Subscription Payment

Insurance & Investment Facility

PhonePe Smart Speaker: A voice-alert device that alerts confirmation of the payment and currently supports 11 languages including English.