Highlights

Zomato faces a ₹803.4 crore tax demand for non-payment of GST on delivery charges.

- The amount includes ₹401.7 crore in GST liability and an equal amount as penalty and interest.

- Zomato to contest the order and file an appeal with support from tax advisors.

- The tax demand has led to a drop in Zomato’s stock price.

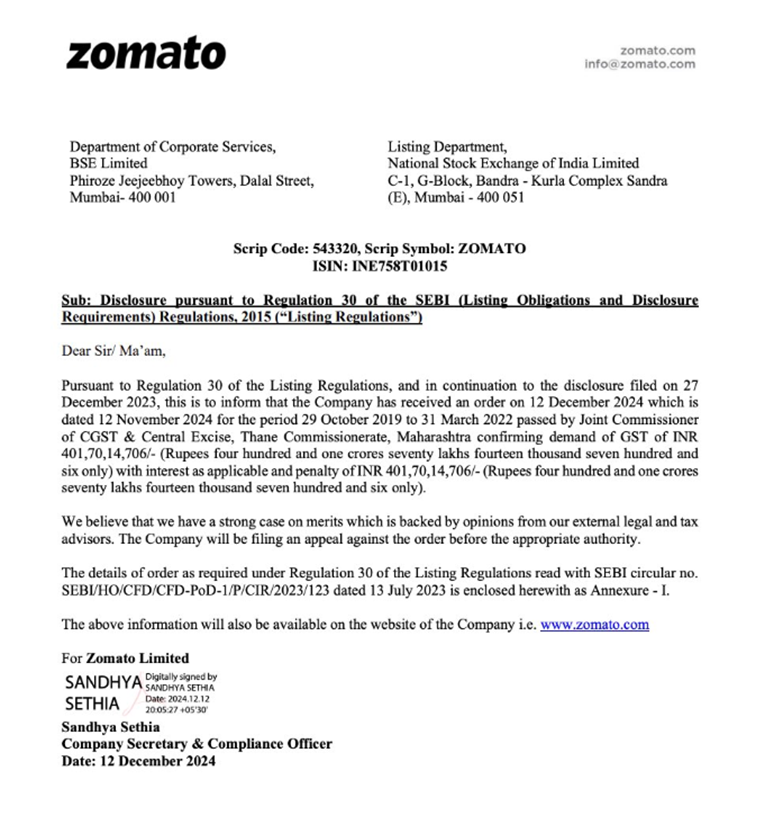

Food delivery company Zomato has been ordered with a tax demand by the Joint Commissioner of CGST & Central Excise Thane Commissionerate Maharashtra.

The ₹803.4 crore order alleges non-payment of goods and services tax (GST) on delivery charges for the period between October 29, 2019 and March 31, 2022.

The total amount includes a GST liability of ₹401.7 crore, an equal amount as a penalty and additional interest.

The tax demand order, issued on November 12, 2024 and served to Zomato on December 12, 2024, focuses on GST compliance related to delivery charges.

The breakdown of the total demand is ₹401.7 crore GST Liability, ₹401.7 crore Penalty and yet to be quantified interest.

This case highlights the complexities of GST rules for digital service platforms, especially around delivery charges that is a key revenue component for companies like Zomato.

Zomato has stated its intent to contest the order.

In a regulatory filing, the company said, “We believe that we have a strong case on merits, supported by opinions from our external legal and tax advisors. We will be filing an appeal against this order before the appropriate authority.”

The company has emphasised its commitment to compliance and plans to challenge the order through legal avenues.

The news of the tax demand immediately impacted Zomato’s stock. On December 12, 2024, its shares closed at ₹284.90, a drop of ₹6.90 (2.36%) on the Bombay Stock Exchange (BSE).

Analysts are closely watching the situation to evaluate its potential long-term impact on the company’s financial stability.

This case has put a spotlight on the regulatory scrutiny faced by food delivery platforms regarding tax compliance.

Delivery charges, a significant part of these companies’ revenue, often fall into grey areas under GST rules. The outcome of Zomato’s appeal could set an important precedent for similar cases involving other industry players.

The company recently replaced JSW Steel in the BSE Sensex, a move that highlights its growing prominence in the Indian stock market.

However, resolving this GST issue will be critical for maintaining investor confidence and ensuring smooth operations going forward.

FAQs

Q1. What is the total amount of the tax demand faced by Zomato?

Answer. The total amount is ₹803.4 crore, which includes a GST liability of ₹401.7 crore, an equal amount as penalty, and additional interest.

Q2. How has Zomato responded to the GST demand?

Answer. Zomato intends to contest the order, stating they have a strong case supported by opinions from external legal and tax advisors. They will file an appeal against the order.

Q3. What impact has the tax demand had on Zomato’s stock price?

Answer. The tax demand led to a drop in Zomato’s stock price, closing at ₹284.90, a decrease of ₹6.90 (2.36%) on the Bombay Stock Exchange (BSE) on December 12, 2024.

Read More: Gurugram Man Accused Zomato of Selling Fake Paneer to Restaurants in Viral Post on X